29 Nov 2016 Eurosmart Confirms Overall Growth Trend For The Smart Security Industry – market figures and forecasts

Steady upward trajectory for worldwide secure element shipments in 2016 and 2017

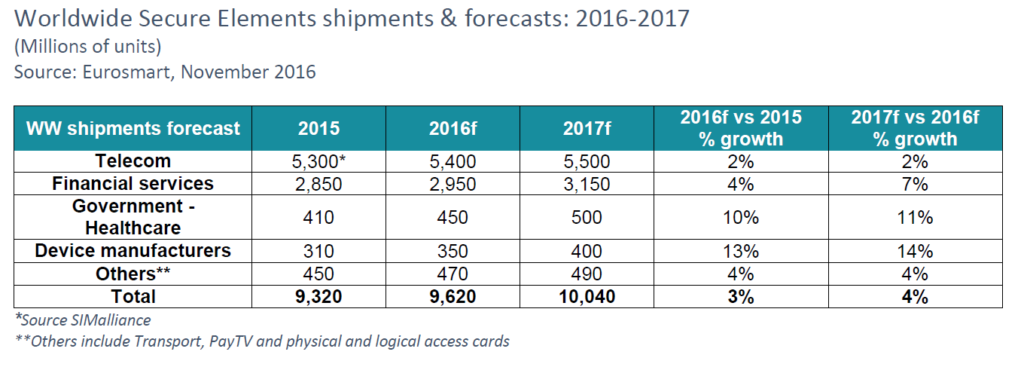

Cannes, 29th of November 2016 – At the opening of TRUSTECH 2016, Eurosmart, the Voice of the Smart Security Industry, presented its annual forecast of worldwide secure element* shipments. The overall growth trend has continued in 2016 and is also confirmed by the 2017 forecasts. Eurosmart expects the number of secure elements shipped in 2017 to exceed 10 billion.

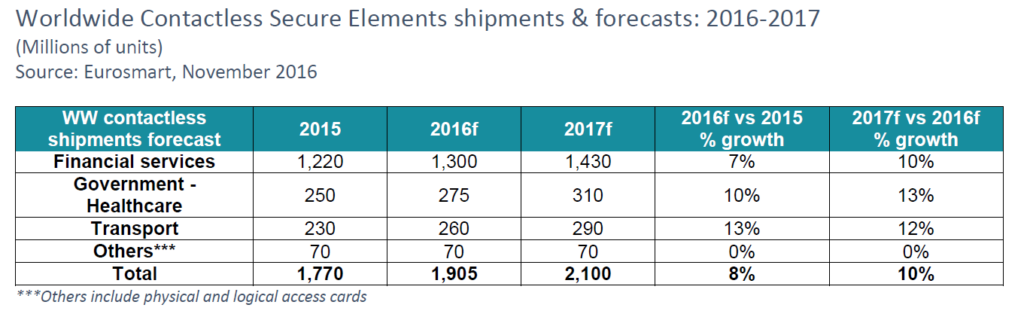

The steady growth in the payment sector, reaching about 3 billion shipments, a growth of 4% by the end of 2016, is mostly driven by the adoption of contactless payment in an increasing number of regional markets. Eurosmart estimates the growth in contactless payment cards at 7% in 2016. The second growth driver is, and continues to be, the increasing migration from magnetic stripe cards to EMV cards in the USA, as well as in India, China, South East Asia and Africa. The third growth driver in the payment sector is mobile payments, as smartphones with embedded secure elements are increasingly used for mobile payment transactions. Further growth will also be due to EU regulations for digital and mobile payments, such as the upcoming Regulatory Technical Standards for strong customer authentication under Payment Services Directive 2 (PSD2). Eurosmart President Didier Sérodon is convinced that security in digital and mobile payment transactions is crucial for the long-term success of these applications: “Trust is essential when it comes to payments, and security is the foundation for trust”.

The double-digit growth expected for 2016 and 2017 in the eGovernment and healthcare sectors is mainly driven by ePassport and national eID projects. Sérodon: “Public e-services are gaining traction. Quick and easy border crossings, for instance, rank highly with travelers. Smart Security Industry technologies, designed to safely manage digital identities while protecting the right to privacy, meet both governments’ and citizens’ requirements. The majority of ePassport and eID projects worldwide rely on products of our members”.

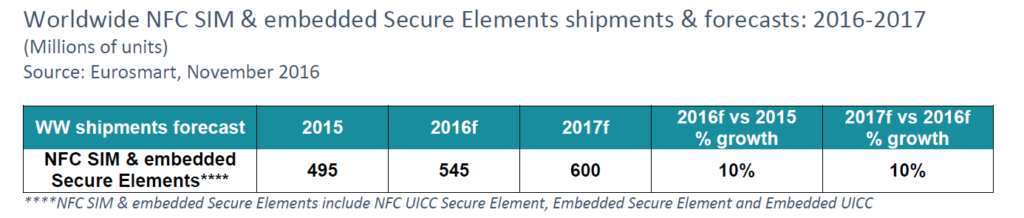

In the telecom sector, shipments of secure elements with a SIM application are expected to be up by 2% in 2016, despite high global market penetration. Ongoing LTE adoption and affordability of low-end smartphones contribute to the continuous growth of the telecom market in various key regions. “Besides IoT technologies, such as connected cars that demand secure and ubiquitous connectivity, there is a growing demand for hyperconnectivity – to be connected anywhere at any time. Eurosmart member companies offer solutions for mobile services to telecom operators which enable secure hyperconnectivity”, Serodon pointed out.

The growth trend for connected wearables, such as smart watches or wristbands, continues. “These devices are particularly vulnerable to attacks”, said Serodon. The past weeks and months had shown that the IoT was a gateway for DDoS attacks, for instance, and in need of more and better security. Eurosmart would continue to promote security standards that protect connected devices as well as the connectivity itself.

“Summing it up”, Serodon stated, “the smart security industry remains a growth area in times of overall economic downturn, both in Europe and worldwide, securing jobs and driving innovation. In addition, it positively impacts many other business sectors. It is our mission to ensure security and data protection for citizens across Europe. For us, regulating the cybersecurity market means implementing standards that safeguard the trust of citizens across Europe”.

About secure elements:

A secure element contains a certified microcontroller and embedded software. It is secure, personal and portable and comes in multiple forms: Eurosmart members manufacture and personalize such secure elements, as well as the software and secure infrastructure around it. Secure elements have a strategic role in protecting digital identities and are vital to ensure digital security and privacy. We divide the market in five main areas:

Telecom: SIM cards (secure elements with a SIM application);

Financial services: cards issued by banks and retailers for payment services (debit, credit, prepaid schemes…); cards issued by retailers or service providers for loyalty services; and social cards with payment application;

Government & healthcare: cards issued by governmental bodies for citizens’ identification (travel, ID and healthcare documents) and online services and cards issued by private health insurance companies;

Device manufacturers: mobile phones, tablets, navigation devices and other connected devices including an embedded secure element without SIM application;

Others: cards issued by operators, for transport, toll or car park services (i.e. “Transport”); cards issued by pay-TV operators for decrypting TV signals (i.e. “Pay TV”); physical and logical access cards.

EurosmartPR_market forecasts 2016